Ornua’s market report for December 2025 paints a mixed picture of the dairy industry, both in Europe and beyond.

Overall, European commodity prices eased further, and market sentiment remains weak.

Meanwhile, the growth in milk supply has been stronger than anticipated, particularly in Europe.

The report adds that while EU-27 flows were flat in the first half of the year, supply may rise by 4.0% in quarter four (Q4).

On the global side, demand is steady, but not strong enough to absorb the extra supply.

Consequently, there is more product available.

According to Ornua, buyers are hesitant to commit too far ahead as Q1 futures are flat or weaker.

Demand usually improves in Q2, the report said, but for pricing to recover, milk supply needs to tighten.

Global exporters

Looking at exporters, collections rose by 4.3% in October with flows expanding in most major regions, according to Ornua.

From January to October 2025, several regions saw exports rise:

- EU-27: Collections lifted by 4.2% in September and by approximately 5.0% in October;

- US: Supply has been strong and expanded by another 3.7% in October;

- New Zealand: Output continues to expand supported by favourable pasture conditions;

- Argentina: Flows continue to improve supported by the removal of export subsidies and higher yield-per-cow.

Meanwhile, in Australia, production is likely to contract by -2.0% in 2025 due to poor weather and rising production costs, according to Ornua.

In China, Milk output will fall in 2025 but there has been signs of stability in recent months, Ornua said.

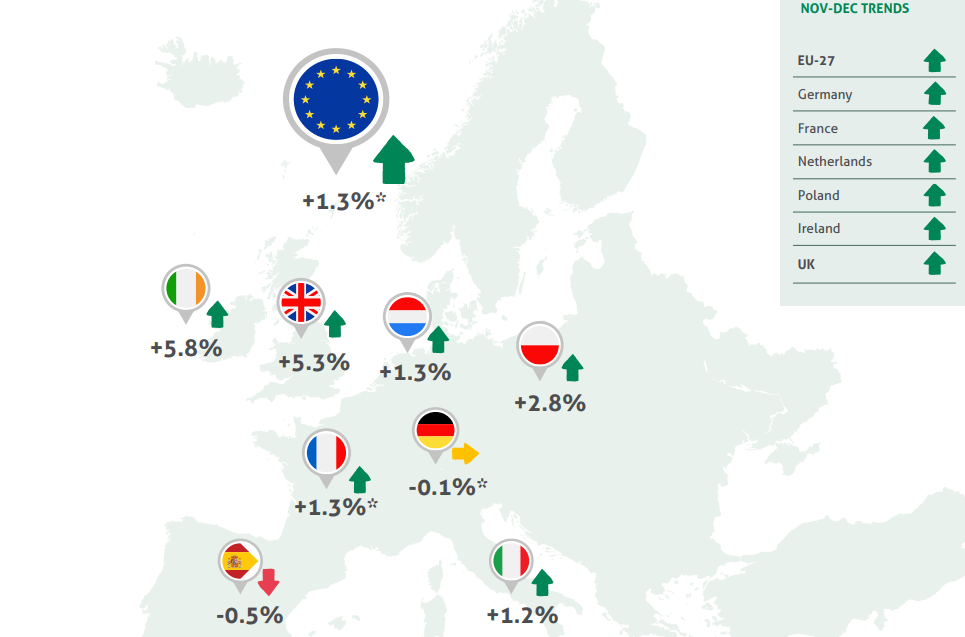

European milk supply

Milk collections in Europe were higher than expected in September and October.

The control of bluetongue played a part, but the improvement in margin and yield-per-cow was significant.

The annual growth forecast was raised from +0.5% to +1.5%.

For 2026, collections are likely to ease, Ornua said.

Looking more closely at specific markets:

- EU-27: Collections lifted by +4.2% in September and by approximately +5.0% in October;

- Ireland: Production was strong again in October (+5.2%) though the rate of growth should ease;

- France: Like Germany, growth was stronger than predicted in September and October:

- The Netherlands: Collections in October were the highest on record. Again, growth is being driven by higher yield;

- Poland: Milk supply has grown consistently through 2025 with October collections up +4.4%;

- UK: Flows have been strong with output lifting by +6.2% in September and +7.0% in October;

- Germany: Production was stronger than expected in September and October driven by higher yield-per-cow.

Overall outlook

Looking at the market outlook overall, according to Ornua global milk supply is expected to grow by +2.2% in 2025, with EU-27 milk increasing by about +4.0% in Q4.

For 2026, EU-27 milk could fall by -1.0% with most of the drop-off occurring in the second half of the year.

Irish flows are forecast to weaken slightly in 2026. Recent cases of bluetongue in Northern Ireland is something to watch out for.

The Ornua report stated that commodity futures are flat with buying activity for January 2026 “usually quiet”.

With milk supply strong, European commodity prices are unlikely to improve significantly in Q1 2026.

However, after a period of modest demand, Ornua expects buyers to return once prices stabilise. The report noted that activity usually picks up in Q2.

According to the report: “The extent to which prices recover depends on how quickly lower milk prices impact yield and slow production.

“Assuming supply eases in Q2 and demand improves, commodity prices should rise in the second half of the year.”

It is “unlikely” that prices will recover to the levels seen in early 2025, Ornua said.