The scarcity of skilled shearers in today’s market landscape is currently posing challenges in the Australian lamb trade.

According to analysis from Meat and Livestock Australia (MLA), leaving lambs unshorn can render it difficult to assess their physical condition and manage weight gain for optimal meat production.

Consequently, MLA research has shown interested buyers are offering discounts on unshorn lambs due to the additional cost and effort required for shearing, rendering them less desirable at saleyards for certain buyers.

The Australian sheep market has had a strong start in 2024, with heavy lamb prices at 786c/kg (carcass weight), a figure not seen since January 2023.

This marked a substantial recovery for the market, following its lowest price point in a decade.

However, a familiar pattern from the previous year seems to be emerging, with prices starting high but gradually easing, by almost 20% compared to the same period last year, a trend which underscores the increased volatility and diverse market pressures impacting prices.

Traditionally, this time of year sees the entry of Australian lamb born in the previous winter enter the market.

This surge in supply has made buyers more discerning, exerting downward pressure on prices and leading to heightened scrutiny of the physical attributes of lambs presented at saleyards.

Australian exports

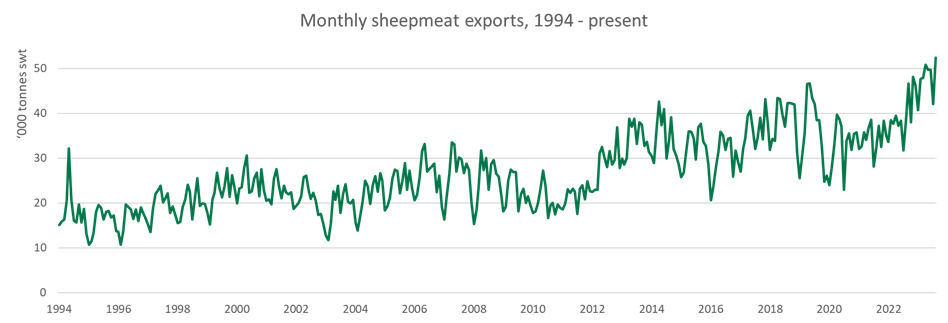

MLA analyst Tim Jackson stated that in February, combined lamb and mutton exports reached 52,351t, marking the highest export volume for any month on record, despite it usually being a month with relatively smaller export volumes.

Jackson stated that export volumes usually peak in the last three months of the year, as the spring flush yields increased production.

In 2024, high slaughter volumes at the start of the year translated into very strong export volumes.

The United States remained Australia’s largest lamb market, with exports rising 36% year-on-year (YoY) to 7,543t.

Meanwhile, exports to China lifted 15% YoY to 5,215t. Mutton exports overall lifted 37% YoY to 21,299t.

China remained the largest market for mutton exports, amounting to 6,639t, while exports to Saudi Arabia experience the most significant growth among major markets, growing by 161% YoY to 1,796t.